The financial services sector moves at a rapid rate. The industry has seen an average year-on-year growth of 31% on social media with companies waking up to the fact that a digital presence is good for business.

Online marketing for finance across multiple channels is not easy, however. You have tons of rules and regulations to think about.

And with the markets affected by everything from political tensions to Trump tweets, staying on top of the news is a must.

As the director of a marketing agency specializing in financial services, I need to stay updated with the latest rules and how to apply them to social media.

So, here’s how to be great at social media for financial services.

Related Post: Social Media Management

1. Comply with Regulation

Financial services are highly regulated, so you cannot possibly hope to make it on social media without complying.

The challenge in social media for financial services is that there is so much going on in this sphere.

CySEC has investor protection powers, and MiFID II regulates the strict protection of consumer information. Both MiFID II and FCA regulation require that all communications are archived, and this is big for social media where a lot of information is exchanged.

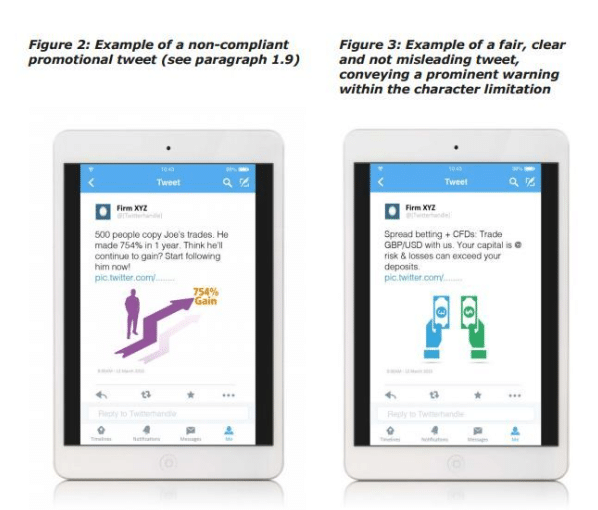

In addition, MiFID II requires that any promotional content be “fair, clear, and not misleading.” GDPR requires that consumers explicitly give consent for the use of their information, and collected data cannot be recycled for any other use other than the initial intended purpose.

These regulations are only a small part of the big picture.

Even the crypto sector, which was not regulated in the past, is increasingly getting more attention regarding regulations across the globe.

For instance, the EU is now clear to crypto businesses on its counter-terrorism finance (CTF) and anti-money laundering (AML) obligations according to the 5th Anti-Money Laundering Directive (5MLD) whose adoption by member states should be achieved by the end of 2019.

Regulators don’t mess around. Compliance is a must. The last thing you want is a reputation loss on top of regulatory fines that can run into the millions just because you overlooked ESMA regulations and used the wrong font size for your risk warning.

Related Post: What to look for in a Social Media Post Scheduler

How to Do Social Media for Financial Services:

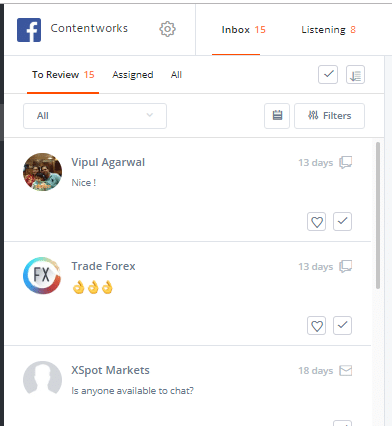

- Ensure that you have reliable privacy protection and record-keeping tools. Agorapulse provides easy reporting for financial services companies and also allows for an approvals hierarchy. This is essential for that all-important compliance sign-off.

- Educate all employees on regulatory requirements. You can organize regular compliance training to help employees stay up to date with regulatory demands. Only assign specific people to post and monitor social media. (Too many cooks definitely spoil the broth here.)

- Always stay in the know about any new regulation updates. Get relevant news on regulation on Bloomberg and follow Reuters on Twitter for timely updates.

- Only use opted-in email addresses for social media retargeting. Yes, I know. We all once used cold leads list to retarget on Facebook because nobody was checking and it seemed less obvious than spamming people on email. But those days are gone. Facebook now binds marketers using lookalike lists to comply with GDPR rules and will impose penalties on marketers ignoring the rules.

2. Mind Facebook’s Crypto Rules

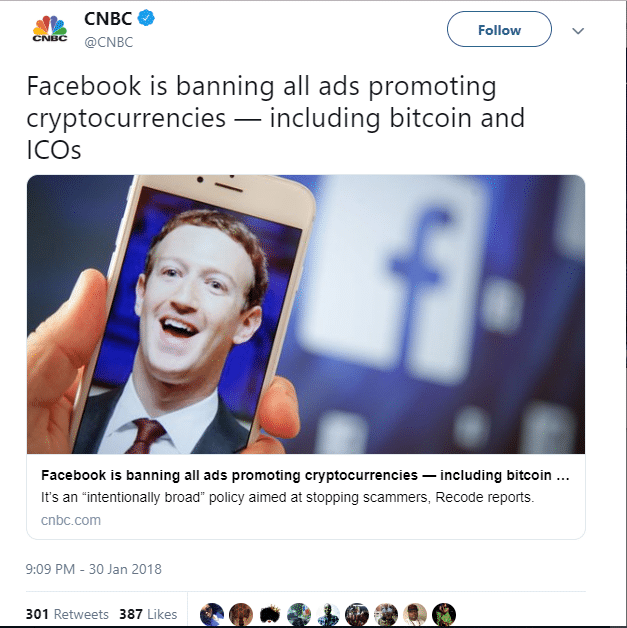

With 2.38 billion active monthly users, Facebook is the largest social media platform in the world. So, its rules definitely matter.

In 2018, Facebook created a policy that prohibited ads that are “frequently associated with misleading or deceptive promotional practices, such as binary options, initial coin offerings and cryptocurrency.” Facebook went on to allow the promotion of crypto and related content with prior approval.

(From personal experience, I found this was a nightmare as Facebook was trigger happy blocking anything that even mentioned cryptocurrencies. Even events or education.)

However, this has once again changed. Crypto advertising no longer requires prior approval. Initial coin offerings and binary options are still prohibited, though.

Given the size of Facebook, its substantial proportion of social media ads and the rolling out of its own crypto, the role of Facebook for financial services is bound to increase.

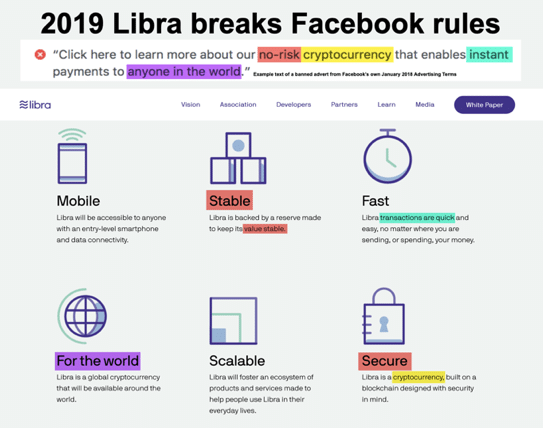

You violate Facebook policies at your own peril, and doing so may even cost your brand some growth and engagement. Facebook’s Libra Coin is not exactly a crypto in the traditional sense but will challenge traditional centralized payment methods. (Oddly enough, Libra does break Facebook’s own rules on cryptos …)

How to Do Social Media for Financial Services:

- Ensure that all employees are familiar with Facebook’s advertising policies and avoid making outlandish claims or guarantees of wealth.

- Always set proper rules for contests and have them signed off by your legal team. Financial services companies are so heavily regulated that they cannot be seen to be tricking customers.

- Craft a Facebook campaign that engages your audience. The New York Stock Exchange (NYSE) has had much success with its Opening and Closing Bell Ceremonies on Facebook. The ceremonies feature top brands that increase NYSE’s exposure, and they also feature people connected to social issues. For example, these ovarian cancer survivors were part of a recent Closing Bell ceremony:

3. Know the Power of Interactive Content

A poll conducted by KPMG revealed that 65% of people would not consider a job in the financial services industry because finance is boring. Unfortunately, consumers believe this misconception and tend to expect boring content from financial services brands.

Your social media strategy has to overcome this preconceived view.

Interactive content like LinkedIn AMA sessions, Q&A stickers on Instagram, and Twitter polls get your audience involved. Marketers say interactive content has a 93% effectiveness in engaging the consumer compared to the 70% of static content. Interactive content makes financial services more engaging, and it works great when coupled with product visualizations.

CoinMetro uses its Tuesday polls and Friday AMA sessions on LinkedIn to keep things lively. On average, the AMA session gets 50% more engagement than ordinary posts.

You need product visualizations to make financial services more human and to allow your brand to be more relatable. See how disruptor bank Monzo uses visualization to bring its brand to life without specifically focusing on its products. Monzo regularly shows the faces behind its name on LinkedIn. Doing so gives consumers a personal view of the brand.

How to Do Social Media for Financial Services:

- Promote brand awareness without focusing solely on salesy content. This can be done through third-party PRs, events, seminars and product launches. Videos and photos will speak for themselves without the need for you to humblebrag!

- Humanize your brand by focusing on people, your work environment and community involvement. Check out how leading forex broker TIOmarkets does this on its Instagram channel, which is dedicated to the team, behind the scenes and even an office doggo.

4. Leverage Social Proof and Influencer Endorsements

One of the key issues that hound financial services (besides compliance and regulation) is mistrust. People struggle to trust financial services brands. So, you need to focus on social media that builds trust and relationships with your audience.

Social proof has grown as a result of people trusting user reviews over what companies have to say about their own products. In fact, close to 70% of online consumers don’t make a purchase before they look at product reviews.

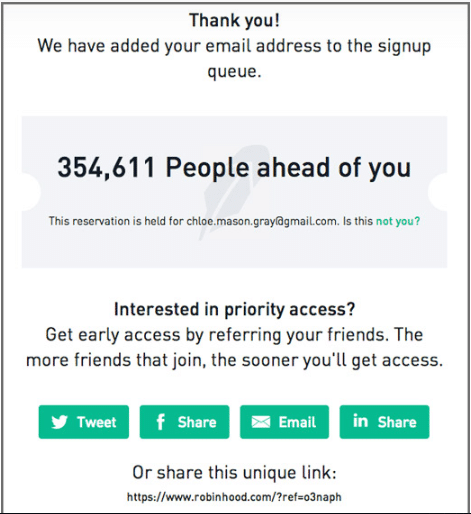

Online trading company RobinHoodApp is a classic example of the power of social proof. The company brought in 1 million referrals before launch. When people saw the number of people signed up, they wanted to be on the list, too.

And then there’s Revolut and the FOMO:

A whopping 49% of social media users depend on influencer recommendations to assist a purchasing decision showing how endorsements are big business. In fact, the influencer marketing industry is set to grow to $10 billion by 2020. A word of caution: Give your audience authentic influencers; otherwise, you risk wasting your money and effort.

Consumers view micro influencers as more authentic than macro influencers. On average, micro influencers get 7x more engagement than macro influencers and are viewed as more relevant by their audiences.

You can also take advantage of micro influencers’ affordable price tag. A whopping 97% of branded Instagram posts by micro influencers cost under $500; macro influencers require $75,000 per post on average. Even top financial brands like American Express leverage the power of micro influencers. The brand increased its reach and engagement by combining micro influencer marketing with something consumers relate to well: food.

How to Do Social Media for Financial Services:

- Partner with and get endorsements from authentic influencers who speak the same language as your audience and brand.

- Use social proof to make your products more relatable to your audience and create a sense of FOMO among social media users.

- Your posts don’t need to be all about finance or selling your products. Look at the wider benefits of your product like its associated lifestyle or the challenges it addresses.

5. Understand the Speed of Finance

The world of finance has two inherent characteristics: volatility and fast movement. Regular information and news updates are vital.

Investors are always on the lookout for issues like FED announcements. So, your social media followers expect you to provide relevant information in a timely manner.

You need to be able to receive and share information promptly.

Twitter remains ones of the most convenient ways to make announcements and give instantaneous updates. In fact, 5787 tweets are sent every single second! Reuters Business regularly updates its Twitter feed to cater to new financial information as it comes in.

Nonetheless, no matter the social platform you choose to go with, the speed of finance and its information demand requirements make for a difficult task. It’s the price you pay to get more interaction and brand growth.

How to Do Social Media for Financial Services:

Gather your Twitter information quickly by using an RSS feed from a reliable source like The Wall Street Journal.

Remember, traders, investors and buyers follow hashtags on Twitter. And they are probably your target audience. Trending finance hashtags include:

- #NYSE – The New York Stock Exchange

- #DOW – Dow Jones Industrial Average

- #NASDAQ – NASDAQ Stock Market

- #SP500 – S&P 500 Index

- #USD – the US dollar

- #EUR – the euro

- #GBP – the Great British pound

- #JPY – the Japanese yen

- #AUD – the Australian dollar

- #NZD – the New Zealand dollar

- #CAD – the Canadian dollar

- #CHF – the Swiss franc

- #XAU – the symbol for gold

- #forex – generic for the forex sector

Traders will follow event hashtags, such as:

- #Trump – Trump’s tweets often cause volatility in the financial markets

- #Brexit – The British pound responds dramatically to Brexit talks

- #OPEC – updates from the Organization of the Petroleum Exporting Countries can have a big effect on the financial markets

- #Fed – Speeches from Fed heads can impact currency price action heavily.

Stay updated on economic events by following financial calendars like the one at Blackwell Global if you’re managing social media for financial services.

6. Run Contests

Running competitions is a great way to attract followers. But how can you navigate such fun social activities amid a heavily regulated sector? Careful planning is necessary to avoid losses and to stay on the right side of the law.

According to MiFID II, you will have to keep records of all your contest entries and communications.

Also, depending on your location, you may have to file additional requirements if your prizes exceed a certain monetary value.

Social media sites like Facebook and Twitter explicitly state in their policies that when running a contest you need to comply with all relevant regulation.

Facebook is huge regarding contests, so you need to familiarize yourself with its rules. Some of its prominent contest rules include …

- Making it clear that you are running a contest and Facebook is not your sponsor.

- Prohibiting any form of consideration from consumers. In some locations, personal information including a person’s name and email are a form of consideration. You will need to know the rules governing the location targeted by your contest.

- The need for explicit contest rules including who is running the contest, how long it’s running for, how winners are chosen, and clear descriptions of the prizes.

- Contests must have a clear risk warning in the right font size, clearly describe the prize and be aware of restrictions within the content.

You don’t want to risk losing your page together with all your followers because you forgot to mention that you are running a contest even if it’s obvious that’s what it is.

You can use Facebook marketing tools like those offered by Agorapulse to make your life easier. These tools ensure that you create contests that comply with Facebook terms and conditions.

How to Do Social Media for Financial Services:

- Confirm your terms and conditions and the suitability of your prizes with your legal team to ensure they comply with regulation. Social media for financial services requires an extra layer of security.

- Use branded hashtags to give your contests some extra visibility. There’s a reason why 70% of Instagram hashtags are branded. This strategy works well for extra exposure.

- Be careful about privacy protection when you announce winners.

- Use approved tools for Facebook contests or polls.

7. Deal with Bad PR

In the financial services industry, bad PR can be bad for business, but it’s not always easy to avoid, especially with so many review sites available for consumers to leave comments on.

Social media plays a big role in humanizing financial services brands. It’s perhaps unsurprising then that about 1 in 5 consumers use social media as their first choice for expressing their dissatisfaction with products and services. Clients are progressively requiring personalized services and voicing their dissatisfaction on social media can put off other clients (remember social proof reviews). You have to know how to handle bad PR because a wrong move can leave you with a crisis on your hands.

How to Do Social Media for Financial Services:

- Always have someone on standby to address your clients’ queries during your working hours.

- Use media monitoring software to ensure you’re the first to know about an online slur.

- Never delete customer complaints but acknowledge them politely. For example, in response to a customer complaint, Revolut replied, “We’re really sorry to hear what happened to you. We’d love to take a closer look into it and see what we can do to help. Feel free to send us a private message here!”

- Have a legal team on standby for consultations before you respond to a client. Remember that traders (especially those who have lost money) will probably take their complaints to the regulators. And any interactions via social media can be used as evidence in a case against you.

8. Provide Value Through Content

Around 74% of consumers make purchasing decisions using social media. In other industries, like fashion or food, a purchasing decision is based on seeing how pretty the actual product is. There’s nothing pretty-looking about financial services, and purchasing decisions are based on perceived value.

You need to allow your clients to get to know you before pitching them any of your products or services. And you can do this by making yourself useful and valuable in the eyes of consumers. Broker FXPrimus stands out on Twitter for its bite-size tips on trading safely. The tips always focus on the customer and are complemented by follow-up tweets focused on trading.

How to Do Social Media for Financial Services:

- Give your clients value by addressing their pain points.

- Provide legitimate and insightful information without trying to sell. An education center that addresses trading or investment questions is ideal.

- Don’t shy away from the wisdom of others. Collaborate where you can to reach an even bigger audience.

9. Create Conversations

Social media is all about fostering communities and conversations, so you need to know how to converse with your audience. The last thing your audience wants is you touting your professional messages and advice without taking the time to listen and engage in conversation.

Revolut, launched as a beta release in Australia. In the days leading up to the launch, the brand kept the conversation going with its audience by using a creative take on a countdown.

Social listening helps with monitoring various social networks to uncover relevant conversations and topics of interest and to plan future social media content. This is no walk in the park and sometimes you need to partner with the right teams to help you create effective dialogue.

How to Do Social Media for Financial Services:

- Ditch the monologue. Join relevant conversations and foster two-way interactions.

- Can you use emojis in your social media? Yes, yes, and again, yes. You can and should.

- Use metrics to analyze your audience’s sentiment so that you can generate conversations that are engaging.

- Get help with your dialogue from professional teams who are well versed in financial services.

* * *

Social media for financial services is a challenging task for marketers. Walking the line between human and professional or trust and daring takes skill and patience.

Sign up now for a FREE demo.